In a move aimed at reducing borrowing costs for consumers, the Federal Reserve announced on Wednesday a 0.50 percentage point cut to its benchmark interest rate. This is the first rate reduction in four years, offering some relief to consumers facing rising costs on mortgages, credit cards, and other loans.

The federal funds rate now sits between 4.75% and 5%, down from its previous range of 5.25% to 5.5%—a level that marked a 23-year high. This adjustment is seen as a significant step, as typical rate cuts tend to be in smaller increments of 0.25 percentage points.

With inflation pressures and signs of a slowing economy, the Fed’s decision reflects its focus on keeping the U.S. economy on track. Several economists had called for a more aggressive rate reduction, pointing to weakening labor markets and broader economic cooling.

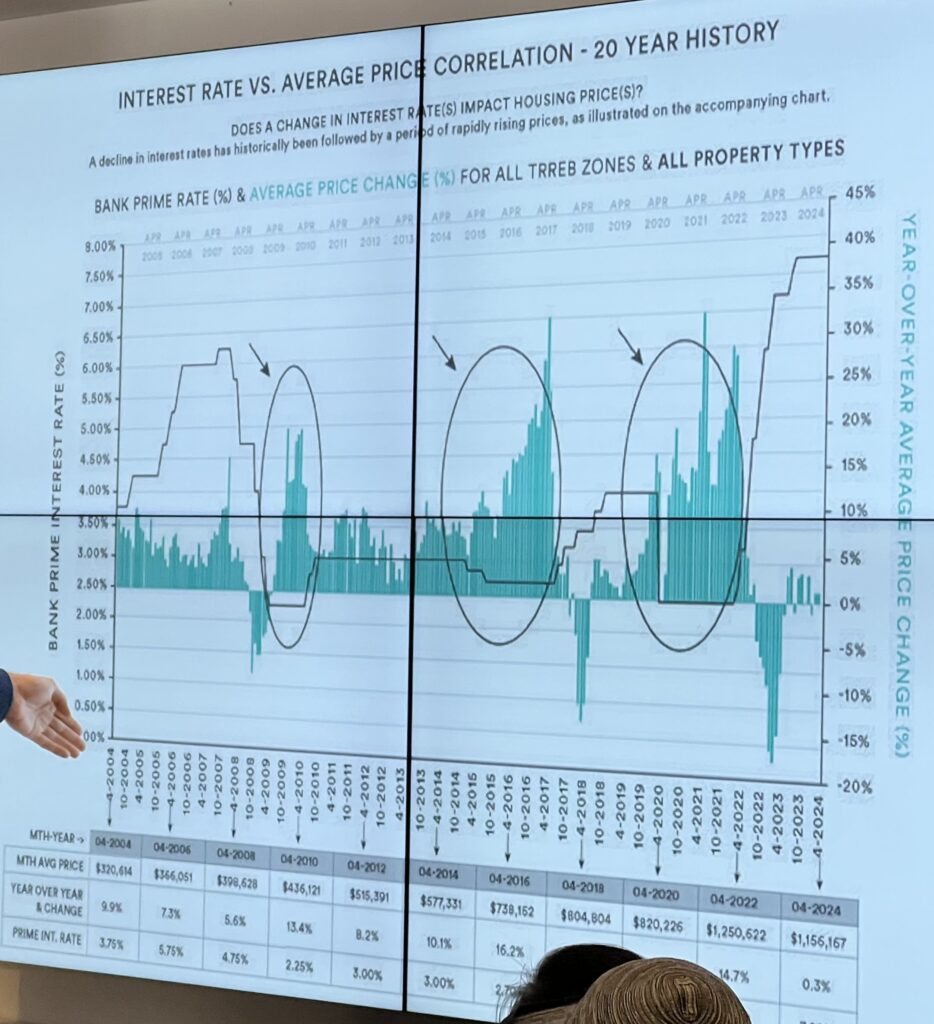

This rate cut is expected to lower borrowing costs, potentially easing some of the financial burdens on homeowners and buyers in the real estate market. The move may also stimulate demand, as lower interest rates often lead to more affordable mortgage options for prospective homebuyers.

Stay tuned for more updates on how these changes could impact the real estate landscape.