Recent amendments adopted by City Council to the Official Plan and Zoning Bylaw will allow for locally-serving small-scale retail, service and office uses to open in the City of Toronto’s residential neighbourhoods. The decision highlights the City’s desire to create vibrant, complete communities that offer a greater number of choices for retail, service and work …

Toronto City Council has approved an increase to development charges that will be phased in over a two-year period in an attempt to manage the impact on community development. Charges for residential and non-residential buildings have been increased. Half of the increase amount will be implemented on May 1, 2023, with the full rates coming into effect …

The Bank of Canada today increased its target for the overnight rate to 2½%, with the Bank Rate at 2¾% and the deposit rate at 2½%. The Bank is also continuing its policy of quantitative tightening (QT). Inflation in Canada is higher and more persistent than the Bank expected in its April Monetary Policy Report (MPR), and …

The City of Toronto has announced an enhanced Home Energy Loan Program (HELP) that will offer zero-interest loans and incentives to help homeowners in Toronto make their homes more energy-efficient and reduce the emissions contributing to climate change. The HELP program has been in existence since 2014, but it has now been enriched and expanded. For a …

From big cities to small towns, the cost of owning a home continues to rise. Young people are finding it more and more difficult to imagine buying a one- bedroom condo—to say nothing of a three-bedroom house. Many of those who’ve been saving for years are being pushed further and further away from where they …

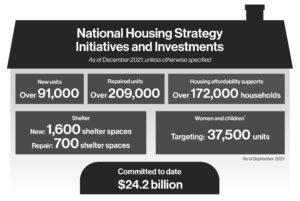

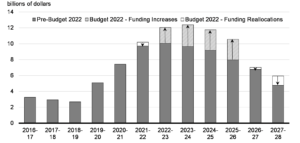

Every order of government has a role to play in building more homes and making housing more affordable for Canadians. Provinces and territories oversee the frameworks guiding land use, planning, and their targets for increasing the number of new homes. Municipalities implement policies in a manner best suited to their communities. To help double our …

Increasing our housing supply will help make housing more affordable, but it isn’t the only solution. There is concern that foreign investment, property flipping and speculation, and illegal activity are driving up the cost of housing in Canada Budget 2022 proposes new measures that will ban foreign investment in residential real estate, crack down on …

Buying a home is often the most significant financial decision that someone will make in their life. However, some real estate practices are putting even more pressure on home buyers and leaving them questioning whether or not they paid too much for their home. Moving Forward on a Home Buyers’ Bill of Rights Unfair practices …

The Bank of Canada today increased its target for the overnight rate to 1%, with the Bank Rate at 1¼% and the deposit rate at 1%. The Bank is also ending reinvestment and will begin quantitative tightening (QT), effective April 25. Maturing Government of Canada bonds on the Bank’s balance sheet will no longer be …

Source: https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a2 Tax-Free First Home Savings Account Budget 2022 proposes to create the Tax-Free First Home Savings Account (FHSA), a new registered account to help individuals save for their first home. Contributions to an FHSA would be deductible and income earned in an FHSA would not be subject to tax. Qualifying withdrawals from an FHSA made …